Burning Questions: A history of the gas industry’s campaign to manufacture controversy over the health risks of gas stove emissions

Download the report here. Since the early 1970s, the gas industry has successfully employed Big Tobacco’s tactics to manufacture and magnify controversy over links between gas stove emissions and respiratory illness, obscuring science and undermining …

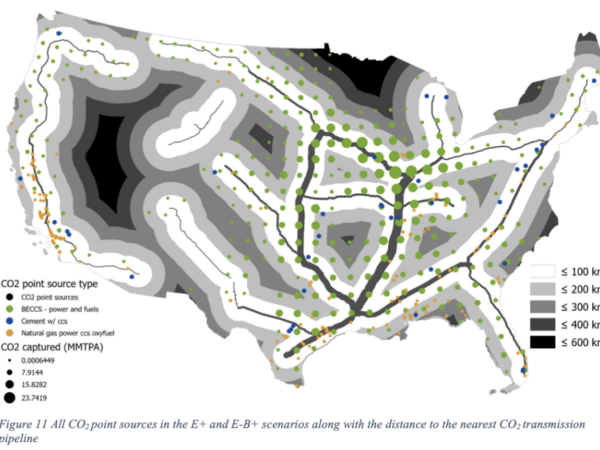

CCS CO2 Pipelines: A Triple 48 Inch Reality Check

I have been calling the carbon capture CO2 pipeline buildout plan a “publicly-funded sewer system for the fossil fuel industry” for some time. In fact it’s their only lifeline, and in the meantime it’s also …

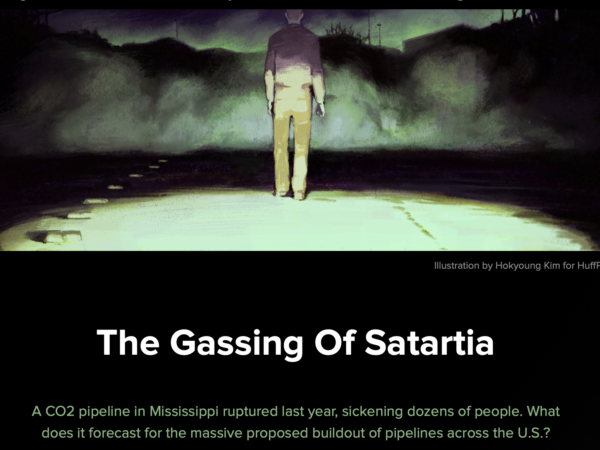

NPR Satartia CO2 Pipeline Story – May 2023

Julia Simon of National Public Radio’s climate team published a marvelous story about the Satartia CO2 pipeline accident that aired on NPR’s All Things Considered. The piece drew from Dan Zegart’s 2021 reporting, including 911 …

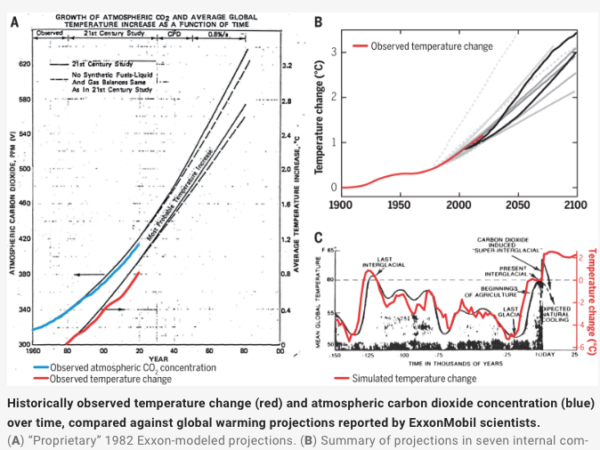

“Assessing ExxonMobil’s global warming projections” Science, January 2023, Supran, Rahmstorf, Oreskes – Reference Documents on ClimateFiles.com

A new study published in Science this week references multiple internal Exxon documents that are available in original form on ClimateFiles. The study got a lot of news coverage: New York Times, Guardian, Associated Press, …

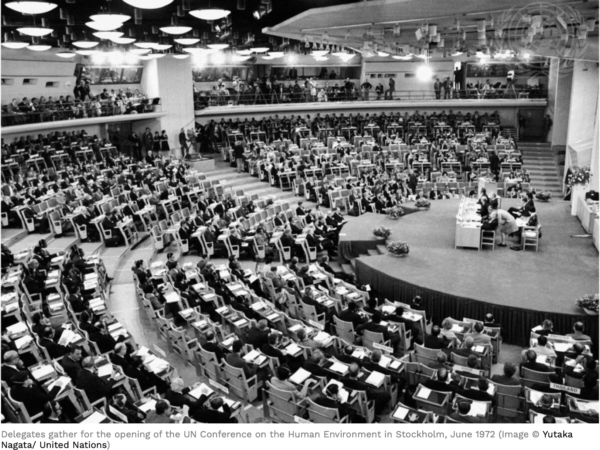

INVESTIGATION: Corporate Polluters Inside US Delegation at UN Negotiations Over Fifty Years Ago

The history of the United States’ involvement in global environmental agreements is a checkered one to say the least. With this project we seek to draw back the curtain and uncover the history of corporate …

CO2 Pipelines 2022: Reference Material

REPORTERS: for access to the full webinar tape, please email is at [email protected] Link to 2021 investigation on the Satartia, Mississippi CO2 pipeline accident: CO2 Pipelines and Carbon Capture: The Satartia Mississippi Accident Investigation CO2 …

New York Times on Exxon, Russian sanctions and the role of oil and gas in Putin’s war on Ukraine

An investigation published on March 24 in the Business Section of the New York Times by Hiroko Tabuchi tells the long history of Exxon/ExxonMobil fighting US sanctions against the USSR and Russia – going back …

CO2 Pipelines and Carbon Capture: The Satartia Mississippi Accident Investigation

Track our ongoing public records investigation here Search a bibliography of reference material from our research here Excerpts from The Gassing of Satartia: A Massive Buildout A Small Town Becomes a Guinea Pig for a …

Imperial Oil Document Trove

Overview of Imperial Oil Document Archive Published on ClimateFiles.com Imperial Oil Limited, Exxon’s Canadian subsidiary, took a very different path from Exxon in the U.S. thirty years ago, revealing the vulnerabilities and strategies of an …

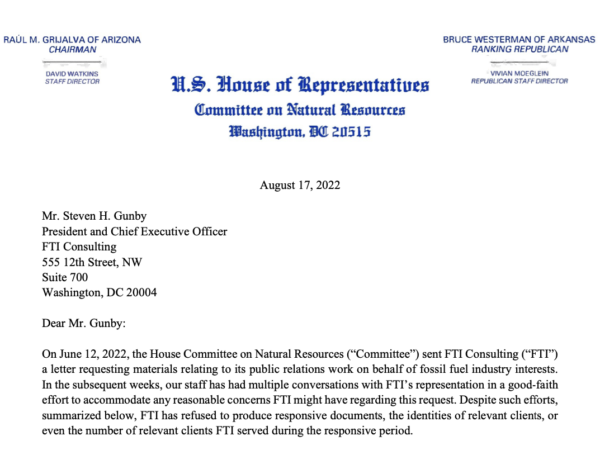

2021-2022 House of Representatives Big Oil Investigations – Document Links

September 2022 Oversight Committee document release https://www.documentcloud.org/documents/22418300-house-oversight-committee-investigation-oil-industry-documents-september-2022-release September 2022 Natural Resources Committee memo and document release December 2022 Oversight Committee document release Memo https://www.documentcloud.org/documents/23560709-2022-12-09-cor-supplemental-memo-fossil-fuel-industry-disinformation Chevron (589 pages) – https://www.documentcloud.org/documents/23451787-chevron-house-oversight-committee-release-december-2022 Exxon (71 pages) – https://www.documentcloud.org/documents/23451825-exxonmobil-house-oversight-committee-release-december-2022 Shell …

Letter Urging McCarthy to Kill House Select Committee on the Climate Crisis: A Who’s Who on the Wrong Side of History

A group of mostly Libertarian, free market, anti-government, anti-regulatory, anti-tax organizations, sent a letter to Representative Kevin McCarthy asking that he disband the Select Committee on the Climate Crisis if Republicans take over the House …

“Americans for Climate Solutions”- a Pennsylvania gas export front group? runs TV ads during 2022 mid-term elections

When I saw this ad on TV in Philadelphia last week, it immediately caught my eye. I was taping some of the rabid ads between the Fetterman and Oz campaigns and this happened to come …

House of Representatives Committee Investigation on Public Relations, the Fossil Fuel Industry and Climate Change

A landmark hearing today in the House Committee on Natural Resources “The Role of Public Relations Firms in Preventing Action on Climate Change” The committee issued a 116 page report to accompany the hearing. The …